Stay up to date on the latest news, alerts and community activities for Greater Nevada Credit Union.

Newsroom

Greater Nevada Credit Union: Put Your Tax Refund to Good Use

GNCU recently joined Fox Reno to share several helpful tips on how to make the most of your tax refund this year.

read more

Greater Nevada Credit Union Serves as Drop-Off Locations for 2024 Movers for Moms Donation Drive

GNCU has teamed up with Two Men and a Truck for the Movers For Moms donation drive to collect items for women escaping violence.

read more

Greater Nevada Credit Union Marks 75th Anniversary With $75,000 in Scholarships for the 2024-2025 School Year

GNCU will award $75,000 in total scholarships for the 2024-2025 school year to qualifying individuals who apply by Friday, March 29, 2024.

read more

Danielle Briggs, Consumer Lending Sales Manager at Greater Nevada Credit Union, Takes a Look at the 2024 Car Market

GNCU’s Danielle Briggs discusses market stabilization, high interest rates, and credit score importance. She also recommends getting preapproved for a confident car-buying experience.

read more

Greater Nevada Credit Union Wants to Make Your 2024 Greater Through Financial Education

Though we believe Living Greater entails more than just having money, we at GNCU also know that financial well-being can be a cornerstone for stability and prosperity in people’s lives. That is why we enjoy partnering with you, our members, to help you set your goals and strive for a greater tomorrow through each step of the way.

read more

Greater Nevada Credit Union Celebrates Holiday Giving Through its 2023 Greater Giving Campaign

GNCU thanks its employees and members in northern Nevada for making Greater Giving 2023 a success. This year, the annual holiday charitable giving campaign focused on making positive impacts to address food and housing security and community health and wellness.

read more

Greater Nevada Credit Union Partners With the Reno Philharmonic for the Spirit of the Season Concert

Elevate the holiday spirit! Join GNCU in collaboration with the Reno Phil for the annual Greater Giving Holiday drive. Donate nonperishable goods and new children’s toys to win tickets for the music of John Williams concert.

read more

Building Up Digital Defenses for Your Small Business: Expert Advice from Stephen Root, Vice President of Information Security for Greater Nevada Credit Union

Protect your small business from rising cyber threats with expert insights from GNCU. Affordable cybersecurity measures for a secure future.

read more

Greater Nevada Credit Union’s Vice President of Member Services, Tom Wambaugh, Talks Payday Loans With FOX 11 News Reno

GNCU’s Vice President of Member Services, Tom Wambaugh, joined FOX 11 News Reno to discuss the pros and cons of payday loans.

read more

Greater Nevada Credit Union and PBS Reno are Partnering to Bring Financial Education to Classrooms Across Northern Nevada

GNCU is partnering with PBS Reno to offer financial literacy workshops to help students in pre-K through fourth grade learn about money, fiscal responsibility, and good savings habits.

read more

Greater Nevada Credit Union Wins The Record-Courier’s Best of Carson Valley 2023 Award

Greater Nevada Credit Union is very proud to have earned the honor of first place in the Best Bank/Credit Union category, making it the ninth year in a row for top honors! Greater Nevada Mortgage, the credit union’s home lending subsidiary, was honored with second place in the Best Mortgage Lender category.

read more

Greater Nevada Credit Union Secures $50,000 Grant for Nevada Nonprofit to Ensure Home Safety for Low-Income Residents

Rebuilding Together Northern Nevada (RTNNV) was recently awarded $50,000 through the Access to Housing and Economic Assistance for Development economic development grant, which Greater Nevada Credit Union helped facilitate. The grant will expand RTNNV’s services to rural Nevada counties including Churchill, Douglas, Lyon, and Storey counties—areas that need similar services.

read more

Greater Nevada Mortgage Grants Middle-Income Homebuyers $50,000 for Down Payment and Closing Costs

Through $1 million in funded down payment assistance, Greater Nevada Mortgage is helping first-time homebuyers turn their homeownership dreams into reality.

read more

Greater Nevada Credit Union Wins Reno News & Review’s Best of Northern Nevada 2023 Award

Greater Nevada Credit Union is very proud to have earned the honor of first place in the Best Bank and Best Credit Union categories. Greater Nevada Mortgage, the credit union’s home lending subsidiary, was honored with third place in the Best Mortgage Company category.

read more

Greater Nevada Credit Union Wins Nevada Appeal’s Best of Carson City 2023 Award

Greater Nevada Credit Union is very proud to have earned the honor of first place in the Best Financial Institute category, making it the winner for two years in a row. Greater Nevada Mortgage, the credit union’s home lending subsidiary, was honored with third place in the Best Mortgage Company category.

read more

Greater Nevada Credit Union Kicks Off Greater School Supplies Drive

GNCU has launched the Greater School Supplies Drive to support Nevada students, teachers, and schools to set them up for a successful academic year. You can drop off donations of new items from July 1 to Aug. 11 at all GNCU branches and Greater Nevada Mortgage’s Carson City and Sparks offices.

read more

Greater Nevada Credit Union’s Vice President of Member Services, Tom Wambaugh, Talks Navigating Finances After Graduation With FOX 11 News Reno

GNCU’s Vice President of Member Services, Tom Wambaugh, joined FOX 11 News Reno to share some important financial advice to graduating students.

read more

Greater Nevada Credit Union Promotes Danny DeLaRosa to President and CEO

GNCU announces Danny DeLaRosa as President and CEO of the credit union. DeLaRosa join GNCU in 2019 and served as Chief Experience Officer.

read more

Greater Nevada Credit Union Announces 2023 Scholarship Recipients

GNCU announces its 2023 Scholarship Recipients which awards 32 college students $2,000 each to pursue their academic goals.

read more

Greater Nevada Credit Union Voted Best Credit Union in Reno Gazette-Journal’s Best of Reno 2023 Awards

GNCU was voted Best Credit Union 2023 in the Reno Gazette-Journal’s Community Choice Awards. This makes the third year in a row GNCU won.

read more

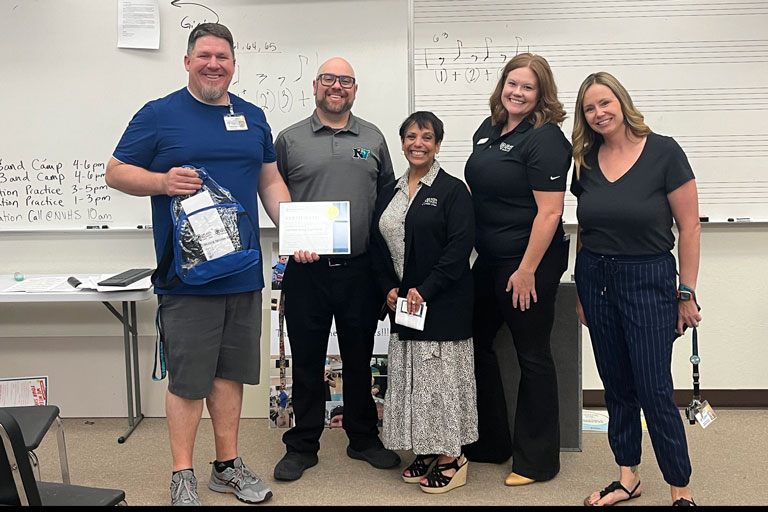

Greater Nevada Credit Union Awards Greater Hearts of Washoe County School District

With the help of their peers, GNCU selected five Washoe County School District employees to win the Greater Hearts of Washoe County awards.

read more

Greater Nevada Credit Union and Greater Nevada Mortgage honored at Eddy House Gala

Eddy House, a Keys to Greater Partner, honored GNCU and Greater Nevada Mortgage with the Founders Award at its first But First Dessert Gala.

read more

Greater Nevada Credit Union’s ‘Bite of Reality’ Program Gives Students a Taste of Real World Financial Planning

Greater Nevada Credit Union brought the ‘Bite of Reality’ budgeting simulation to Elko High School seniors during National Financial Literacy Month.

read more

Greater Nevada Credit Union and Expert Panel Discuss Financial Wellness and Health

On April 5, a group of financial and health experts talk about the link between financial wellness and mental and physical health.

read more

Greater Nevada Credit Union Sponsors Return of Dragon Lights Reno for the Summer of 2023

Dragon Lights Reno returns for the summer of 2023 running from June 30 to August 13 in the Wilbur D. May Arboretum and Botanical Gardens.

read more

Jen Treadway Joins Greater Nevada Credit Union as Senior Vice President of People and Culture

Greater Nevada Credit Union (GNCU) recently announced Jen Treadway as its Senior Vice President of People and Culture. With a 20-year career in people operations, Treadway is experienced in talent management, training, employee experience, human relations, and organizational development.

read more

Greater Nevada Credit Union CEO Talks About the State of the Financial Industry

GNCU CEO answers questions about deposit security, interest rates, and mergers in the banking sector with Northern Nevada Business Weekly.

read more

Greater Nevada Credit Union Serves as Drop-Off Locations for 2023 Movers for Moms Donation Drive

Greater Nevada Credit Union has teamed up with Two Men and a Truck for the Movers For Moms donation drive to collect items for women escaping violence.

read more

Greater Nevada Credit Union Shares Ways To Be Financially Resilient With KOLO 8 News

Tom Wambaugh, VP of Member Services, talks to KOLO 8 about how to stay financially resilient during tough economic times.

read more

Greater Nevada Credit Union Announces Board of Directors at 74th Annual Meeting

Greater Nevada Credit Union (GNCU) held its 74th annual meeting virtually on Tuesday, March 14, to announce the results of its Board of Directors election, give voice to members and recognize those who have held membership at the credit union for 35 years.

read more

Greater Nevada Credit Union Talks About Sticking To Your Financial Goals

Though New Year’s resolutions can be tough to keep, making sure you have a financial safety net pays off throughout the year, says our VP of member services.

read more

President and CEO of Greater Nevada Credit Union, Announces Retirement

Wally Murray, President and CEO of Greater Nevada Credit Union (GNCU), announced his retirement after 35 years at the credit union.

read more

Greater Nevada Credit Union Shows How You Can Make the Best of Rising Interest Rates

Although high interest rates make it more expensive to save money, you also get better returns on Saving Accounts and Share Certificates.

read more

Greater Nevada Credit Union CEO Participates in Housing Summit

GNCU President and CEO Wally Murry participated in the Homeownership Solutions Summit hosted by the Federal Home Loan Bank of San Francisco. The summit took place on Jan. 24 in Reno, Nevada.

read more

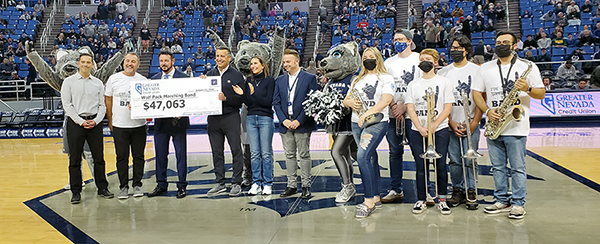

Greater Nevada Credit Union Presents $35,000 Donation to University of Nevada Marching Band

GNCU CEO Wally Murry, Senior VP of Communications Michael Thomas, and VP of Member Services Tom Wambaugh presented a $35,000 check to the University of Nevada, Reno’s Marching Band, during the Men’s Basketball game on Feb. 3.

read more

Greater Nevada Credit Union’s Tom Wambaugh Joins Credit Union Leaders to Discuss 2023 Economic Forecast

Sponsored by the California and Nevada Credit Union League (CCUL), Tom recently joined Jennifer Denoo (CEO of Great Basin FCU), Todd Sorenson (CEO of Elko FCU) and Dr. Robert Eyler (League Economist and Board Member for Redwood CU) on the Your Economy – Your Credit Union videocast to discuss Northern Nevada’s economic forecast for 2023.

read more

Greater Nevada Wins Two Best in Business 2022 Awards by Northern Nevada Business Weekly Readers

Northern Nevada Business Weekly annually asks readers in the region to nominate and vote on the best businesses and organizations in multiple categories. This year, GNCU earned the top honor of Best Financial Institution, and GNM earned the top honor of Best Mortgage Company.

read more

Greater Nevada Credit Union Hosts Dragon Lights Tour for the Blind

GNCU partnered with the Northern Nevada Chapter of the National Federation of the Blind to give a tour of Dragon Lights Reno to those who are visually impaired. Tour participants got to feel and experience these sculptures made of steel and fabric while a guide brought the lanterns to light.

read more

Greater Nevada Credit Union Expands Banking Support for Cannabis-Related Businesses

In an effort to offer more traditional banking services to a rapidly growing, cash-based industry, Greater Nevada Credit Union is supporting cannabis-related businesses (CRBs) through its suite of banking solutions. GNCU made the decision to offer these services in an attempt to cater to the underserved industry, remove cash as a barrier for CRBs and is doing so in-line with legal and regulatory guidelines.

read more

Greater Nevada Credit Union Wins Best of Carson Valley 2022 Award

Carson Valley’s newspaper, The Record-Courier, annually asks readers and members of the local community to nominate and vote on the best businesses and organizations in the area in multiple categories. This year, GNCU earned the honor of Best Bank/Credit Union of Carson Valley.

read more

Greater Nevada Credit Union Wins Best of Carson City 2022 Award

Chosen by members of the community and Nevada Appeal readers alike, Greater Nevada Credit Union won 1st place in the Best Financial Institute category for the 2022 Best of Carson City Awards. The credit union came in 2nd place in 2021 in the same category.

read more

Greater Nevada Credit Union Announces 2022 Scholarship Recipients

GNCU announces its 2022 Scholarship Recipients which awards 30 college students $2,000 each to pursue their academic goals.

read more

Greater Nevada Credit Union Awards $60,000 in Higher Education Scholarships

GNCU has awarded 30 Nevada students with scholarships to continue their academic pursuits through the GNCU Scholarship Program. Since its inception in 2000, GNCU’s scholarship program has helped over 375 students pursue their educational goals, awarding nearly $550,000 in total scholarships over the years.

read more

Greater Nevada Credit Union Recognized Educators for Their Impact on Students and Schools

In honor of National Teacher Appreciation Week, GNCU recognized community educators through its first-ever ‘The Greater Heart of Washoe County School District’ campaign. Nearly 200 educator nominations were submitted by their peers within the school district and six honorees were selected for their impactful efforts helping students and schools achieve more. Winners received $500 each for their school or classroom.

read more

Greater Nevada Credit Union Donates $10,000 to Ukrainian Credit Union Displacement Fund

GNCU has announced its support of the Ukrainian Credit Union Displacement Fund via a $10,000 contribution to the Worldwide Foundation for Credit Unions (WFCU).

read more

Greater Nevada Credit Union Achieves CDFI Certification

GNCU has been certified as a Community Development Financial Institution (CDFI). The U.S. Department of Treasury issued the certification to GNCU in January of this year. With $1.6 billion in assets, GNCU is both the largest financial institution and the only CDFI-certified credit union with headquarters in the state of Nevada.

read more

Greater Nevada Credit Union Donates $17,250 to the Food Bank of Northern Nevada

GNCU is proud to support the Food Bank of Northern Nevada – recently donating $17,250 to the Feeding America member organization.

read more

Greater Nevada Credit Union Contributes Over $47,000 to the Nevada Wolf Pack Marching Band for 2020/21

GNCU has contributed $47,063 to the University of Nevada Marching Band based on a long-standing presenting sponsorship of the group, plus money raised at the University branch and elsewhere in 2020 and 2021. All money donated will go to help with the Band’s needs for instruments, scholarships, travel and other expenses.

read more