Read This Before You Decide To Use A Buy Now, Pay Later Loan

If you’ve bought anything online recently, you might’ve noticed online retailers offering the option of Buy Now, Pay Later Loans when you click to check out.

This type of loan—also known as a point-of-sale loan—gives you the option to pay off your purchase with bi-weekly or monthly payments over a period of time. Unlike credit cards, many Buy Now, Pay Later Loans (BNPL for short) offer 0% interest and no penalties for late payments.

How Some Buy Now, Pay Later Can Affect Your Credit Score

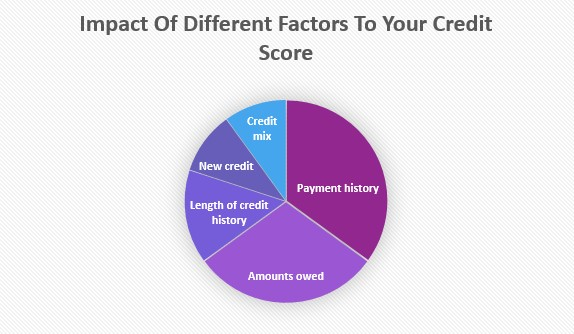

Five factors influence your FICO credit score, and each is weighted differently:

- Payment history (35%): Your track record of making on-time payments

- Amounts owed (30%): How much credit and loans you’re using compared to how much you have available, also known as your utilization rate

- Length of credit history (15%): How long you’ve had access to credit

- New credit (10%): How frequently you apply for and open new accounts

- Credit mix (10%): The variety of credit products you have, including credit cards, installment loans, finance company accounts, mortgage loans, auto loans, and more

Changes to each of these factors can impact your credit score negatively or positively. In the case of point-of-sale loans, also called POS loans, these can affect your credit score in the following ways:

- Payment history: If you make payments on time for your Buy Now, Pay Later Loan, it could positively impact your payment history.

- Length of credit history: The credit reporting agencies consider each purchase using a POS loan as a separate loan. Once you complete the payments, the loan then closes. Having a series of quick loans like this can bring down the average age of your credit history and decrease your credit score as a result.

- New credit: Likewise, repeatedly applying for new BNPL loans will also demonstrate the frequent opening of new accounts and could hurt your credit score.

How the company that offers the BNPL loan reports usage to credit agencies will also impact your credit score.

Various companies offer POS loans, including popular providers such as AfterPay, Affirm, and Klarna. Each handles how they report user activity to the major credit bureaus in a different way.

For example, Affirm, which recently announced a partnership with Amazon, doesn’t report loans with a 0% annual percentage rate (APR) and four biweekly payments or loans where people were given the option of a three-month payment term with 0% APR to Experian, one of the three major credit reporting agencies. Affirm will report the entire loan history to Experian for other loans with different APRs or durations, but not other bureaus such as Equifax and TransUnion.

On the other hand, AfterPay does not consider itself a POS provider, doesn’t perform a credit check, and doesn’t report loans to the credit bureaus.

Klarna performs a soft credit check if you take out a loan meant to be paid off in four payments or 30 days. This type of check won’t affect your credit score. But, if you apply for a branded open line-of-credit product offered by Klarna’s partner bank, a hard inquiry may be conducted, which would impact your credit score.

For all these reasons, it’s crucial to make sure you’re clear on the terms and conditions of any Buy Now, Pay Later loan and understand the interest rate and repayment schedule.

Alternatives to Buy Now, Pay Later Loans

Because POS loans could have an unexpected effect on your credit score, it’s worthwhile to consider other options for paying for large purchases.

One alternative is a personal line of credit, which gives you immediate access to funds whenever you need them. Unlike a traditional lump-sum loan, you don’t have to use your line of credit all at once—or at all. And you only pay interest on what you use. Personal lines of credit can also help build your credit score. When used responsibly, an open line of credit can reflect positively on your credit score by demonstrating the longevity of activity and usage ratio.

Another option, especially if you’re thinking about using a BNPL for holiday shopping or another event you can plan for, is to save strategically for that purchase. For example, a savings account like our Christmas Club will help you save regularly throughout the year with automatic deposits. Then, come Nov. 1, you’ll receive the money you’ve saved, plus the interest it earned.

Buy Now, Pay Later Loans: Should you use them?

When deciding if you should use a financial product, it’s important to do your research. Other options to consider are a personal loan or a personal line of credit.