Click an option below to jump to that specific section.

Dispute Account Activity

Disputing Fraudulent Transactions on Your Account

You can dispute fraudulent transactions in two ways:

- Online: Log into your Digital Banking account and dispute the charge in your account’s Transaction History.

- Phone: Call our fraud hotline at (775) 334-8635, Monday – Friday from 8:00 AM – 5:30 PM. If you think any of your account information is compromised, then they will be able to place a block on your account.

Online Dispute Process

Here’s how you can dispute transaction through your Greater Nevada Digital Banking account (Please note: You can only dispute 10 of the same item at a time):

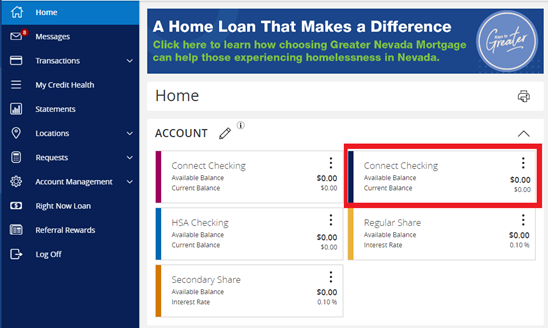

1) Log into your Digital Banking account by clicking the “LOG IN” button found at the top of any page of our website.

2) Click on the account tile to open the account to find the transaction you wish to dispute.

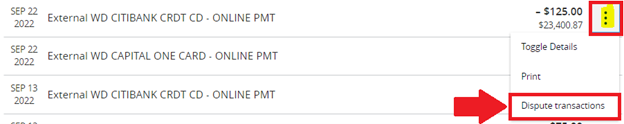

3) Find the transaction you want to dispute and click on the three vertical dots. A dropdown menu will appear. Click ‘Dispute Transaction.’

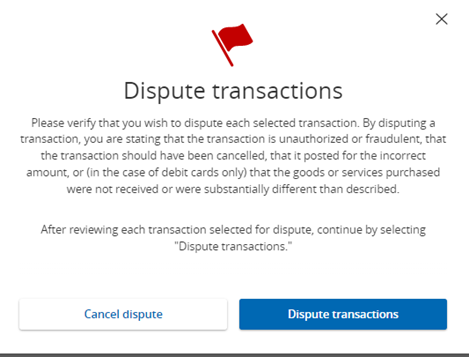

4) A pop-up form will appear. Select ‘dispute transaction’ or cancel. Then select ‘continue dispute.’

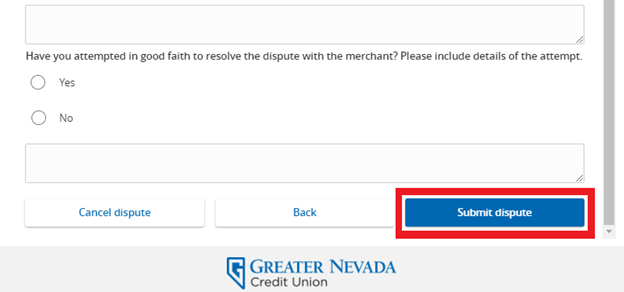

5) Provide more details about the disputed transaction in this form.

6) After filling out the form, click ‘Submit dispute.’

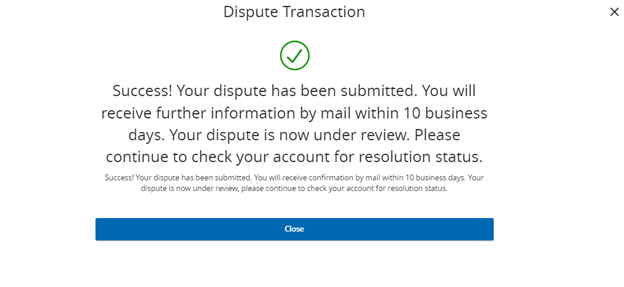

7) A successful submission notice will appear, and GNCU will process the dispute.

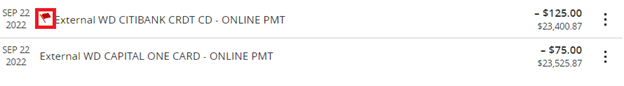

8) Red Flags will mark transactions you submitted for dispute. When a fraudulent or unauthorized transaction is confirmed by GNCU, we will remove it from your account.

Reporting Other Fraud Transactions

Upon completing the form, either drop it off at your local Greater Nevada branch or email it to us at alertfraud@gncu.net.

Affidavit of Forgery of Checks – Fraudulent use of checks (stolen, lost, and fake checks using your account information)

ACH Dispute Form – To dispute a third party using your account and routing number. This can be used for both fraudulent and non-fraudulent instances.

- Example of a Fraudulent ACH Dispute: Someone using your account information to make payments without your permission or knowledge.

- Example of a Non-Fraudulent ACH Dispute: A company you wanted to pay took the wrong amount from your account, or charged more than once.

Report Suspicious Communications

Scammers have been texting, emailing, and calling posing as Greater Nevada Credit Union in an effort to trick members and non-members to share personal information.

Report Lost or Stolen Card

Report a lost or stolen GNCU debit card or credit card immediately by calling the appropriate number listed.

Travel Notification

Before you depart on your next adventure, let us know where you will be headed so we can put a travel alert on your GNCU Visa debit card in order to prevent any possible security issues and to help prevent any fraudulent activity.