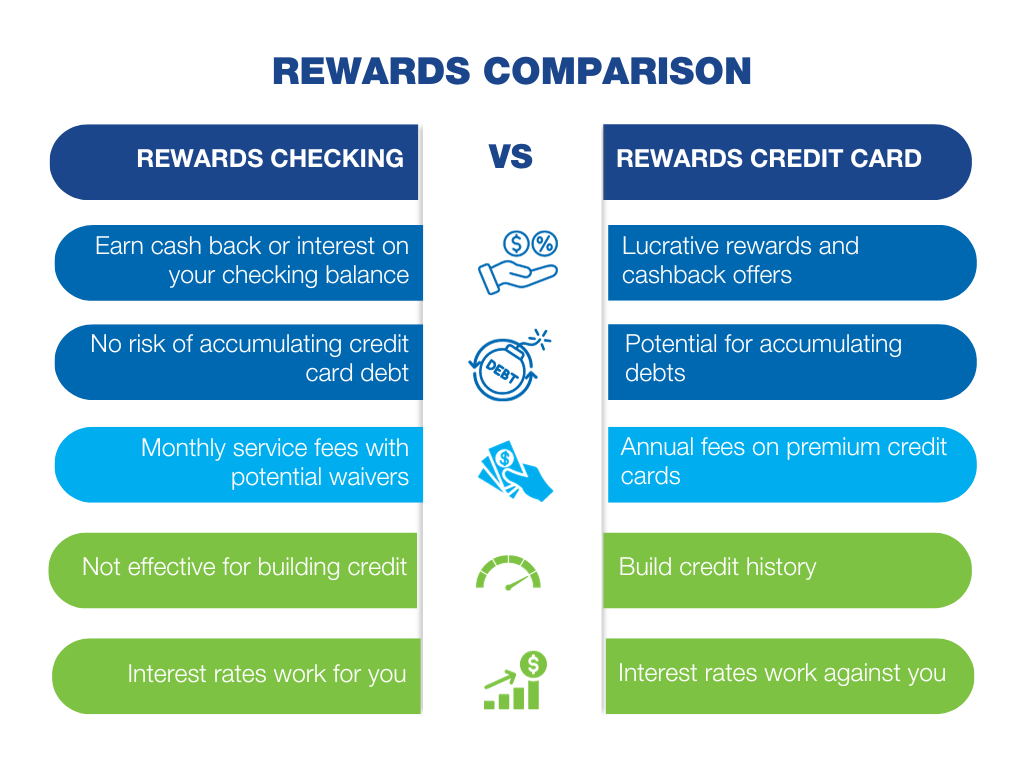

Rewards Checking Accounts vs. Rewards Credit Cards

In the world of personal finance, two heavyweights battle for your attention: rewards checking accounts and rewards credit cards. Both promise rewards and perks, but they serve different purposes. Let’s compare their features, advantages, and potential drawbacks to see which one suits you best.

Rewards Checking Account

What’s the Deal?

- Cash Back or Interest Rewards: You earn cash back or higher interest rates on your account balance.

- No Annual Fee: Typically, no annual fees are involved.

- ATM Fee Reimbursement: Some accounts reimburse out-of-network ATM fees.

- Minimum Balance Requirements: You might need to maintain a minimum balance.

- No Credit Risk: No risk of credit card debt, as you spend your own money.

Lean more about GNCU’s Rewards Checking

Rewards Credit Card

What’s the Offer?

- Points, Miles, or Cash Back: Earn points, airline miles, or cash back on purchases.

- Credit Score Impact: Responsible use can boost your credit score.

- Annual Fees: Some cards have annual fees for premium benefits.

- Interest Charges: Carrying a balance results in interest charges.

Learn more about GNCU’s Rewards Credit Cards

Choosing Wisely

Choose a Rewards Checking Account if:

- You want to avoid credit card debt.

- You prefer using your own funds.

- You can maintain the required minimum balance and meet account qualifications (if any)

Choose a Rewards Credit Card if:

- You’re a responsible credit card user.

- You aim to maximize rewards on everyday spending.

- You value purchase protection and premium perks.

In many cases, a balanced approach can work best. Use a rewards checking account for daily expenses and add a rewards credit card for larger or specific purchases. Just remember, responsible financial management is crucial to maximize benefits and avoid pitfalls. Make your choice and let the rewards begin!