Greater Nevada Credit Union constantly monitors for unusual and suspicious activity on behalf of our members, but understanding how you can proactively protect your identity and how to spot potential scam attempts is very important, too.

How to Protect Your Identity

Fraud Communications Posing as Greater Nevada

You may receive communications claiming to be from Greater Nevada Credit Union, here’s what you need to look out for:

- Unsolicited phone calls asking you to verify your personal information, account information, and GNCU debit or credit card information. Scammers may ask members to report transactions to them, but don’t provide any accurate transaction history themselves. Scammers then inform members they have shut their debit or credit card down and a new card will be sent to them, but they can expedite shipping for a fee. Scammers might also tell members they can’t go into a branch to get a new card, which is not the case. If anyone calls and requests this information, please do the following:

1) Hang up

2) Note the phone number that called you

3) Contact our fraud team by submitting a report of an unsolicited suspicious communication received through our Reporting Suspicious Unsolicited Communications form - Unsolicited emails or SMS/text messages asking you to verify your personal information, account information, and GNCU debit or credit card information by replying back or through an online form. If you are sent an unsolicited request to reply back via email/ text or visit an online form to supply this information, even if the form looks like it could be from GNCU, please do the following:

1) Note the phone number/email address/domain of the website

2) Delete the message or exit the page

3) Contact our fraud team by submitting a report of an unsolicited suspicious communication received through our Reporting Suspicious Unsolicited Communications form

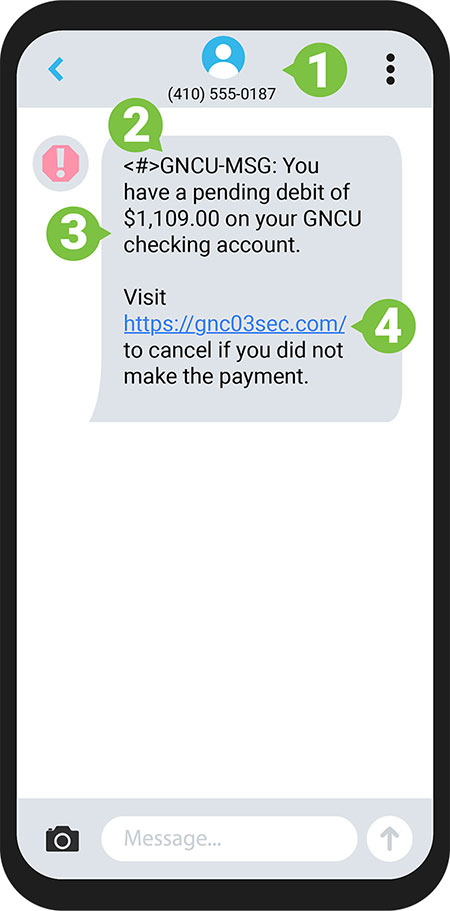

Be on the lookout for fraud SMS/texts (also known as smishing):

- SMS/text messages can look official, but pause before you act.

- Confirm if the message is from your financial institution.

- Look for unusual or irregular requests often paired with a sense of urgency.

- Watch out for links to a URL which is suspicious or shortened to hide identity.

More Tips to Protect Your Identity and Accounts

- Keep GNCU informed with your most current contact information at all times, so we can alert you when potential fraud is detected.

- Regularly review your account activity and immediately report anything suspicious. Whether you’re on a desktop, tablet, or using the Greater Nevada Mobile app, take advantage of our free Greater Nevada Digital Banking to monitor your accounts. Security features include two-factor authentication, custom alerts to notify you of withdrawal and deposit activity, mobile deposit capability, and more.

- Download the GNCU Cards app to manage your GNCU Visa debit card. You’ll enjoy complete control over your debit card and have the peace of mind to spend with confidence. Some of the security features include the ability to turn your card on/off with the flip of a switch, transaction alerts, spending limits or blocking certain purchase types, and more.

- Insert — don’t swipe — your debit card. The EMV chip in your debit card provides the highest level of security available for protecting your card information. Always insert your card and avoid swiping it whenever possible.

- Ensure that each person listed on an account has separate Digital Banking login information. For example: Person A and Person B are both on an account together, both Person A and Person B have separate login IDs and passwords. Please use the login information associated with yourself, not the joint owner.

- Consider changing your password for Digital Banking every three months. Create complex passwords that identity thieves cannot guess easily. Have your password be unique — no birthdays, social security numbers, phone numbers, or any other information that is easy to figure out. Change your passwords ASAP if any companies you do business with have data that has been compromised.

- Watch our short tutorial on Identity Protection in the Greater Financial Education Center. The short video provides great information on protecting your valuable information including how to combat and cure identity theft.

- Make sure your debit cards/credit cards/account information/checks are all in a safe place. If you carry these on your person, be aware of your surroundings when shopping. Make sure after every purchase you remember to put your card away in a safe place where it can’t be stolen or lost.

- Secure your personal devices by placing locks on phones and computers. Enable the security features on mobile devices, especially if you have contacts, banking websites and applications saved.

- Don’t keep your debit card PIN number written down anywhere.

- Secure your Social Security Number (SSN). Don’t carry your Social Security card in your wallet or write your number on your checks.

- Collect mail promptly. Put a hold on your mail when you are away from home for several days. Report any un-received mail to your appropriate vendor. Also, be aware of your billing cycles. If bills or financial statements are late, contact the sender.

- Shred unnecessary receipts, credit offers, account statements, and expired credit cards to prevent “dumpster divers” from getting your personal information.

- Update sharing and firewall settings when you’re on a public Wi-Fi network. Consider using a virtual private network, which can give you the privacy of a secured private network.