Greater financial know-how can lead to Greater opportunities for your family, friends, and (of course) you! Browse through our various financial & lifestyle tips to help you thrive.

Live Greater Blog

Budgeting

7 Financial Wellness Tips to Keep Your Spending Plan on Track

Stay on track with your spending plan, improve your financial wellness, and plan for a stronger financial future with these tips.

read more

Budgeting

5 Essential Money Habits for a Stronger Financial Future

Learn how to build better money habits, create a spending plan, grow your emergency fund, and make smarter financial decisions.

read more

Banking

Eco-Friendly Finances: How to Go Green With Your Money

Learn how your money choices—like green banking and sustainable investing—can reduce your carbon footprint and support a healthier planet.

read more

Business

5 Financial Strategies to Grow Your Small Business

Spring is the perfect time to refresh your business strategy. Discover five practical financial tactics to help your small business grow—like managing debt, diversifying income, and streamlining operations.

read more

Credit Unions

How are Credit Unions Different From Banks?

Learn how credit unions and banks compare, and see how high-yield checking, lower fees, and community-focused banking can benefit you.

read more

Budgeting

Saving for Summer: Plan Your Vacation Budget

Ready for an unforgettable summer vacation? Start saving now with these smart budgeting tips! From travel discounts to side hustles, learn how to reach your vacation goals without breaking the bank.

read more

Taxes

Make Tax Season Easier: Filing Early & Smart Savings

Get ahead this tax season! Learn why filing early can speed up refunds and reduce stress. Explore tax-advantaged accounts to save more.

read more

Loans & Credit

8 Tips to Improve Your Credit Score

Build your credit with smart strategies and GNCU resources. Learn how to improve your credit score and achieve your financial goals.

read more

Budgeting

Small Changes, Big Savings: 10 Habits to Save More in the New Year

Start the new year off right by implementing small, practical money-saving habits that can add up to make a big difference.

read more

Savings & Checking

FAQs About HSAs: Understanding GNCU’s Health Savings Account

Health Savings Accounts (HSAs) serve as an effective financial strategy to cover medical costs while planning for future savings.

read more

Budgeting

Financial Goals for 2025: How to Build a Budget You’ll Stick To

Build a budget you’ll stick to in 2025. Get tips on setting financial goals, tracking progress, and overcoming challenges

read more

Business

Preparing for the Year Ahead: A Financial Checklist for Small Business Owners

As the year winds down, small business owners face a unique opportunity to reflect, plan, and position themselves for success in the year ahead. GNCU understands the challenges entrepreneurs face, and we’re here to help with a comprehensive year-end financial checklist tailored for small business owners.

read more

Loans & Credit

Explore Top Refinancing Options with Greater Nevada Mortgage

As interest rates shift, refinancing offers homeowners an opportunity to reduce costs, simplify their mortgage structure, and unlock the value of their home equity. GNCU and our mortgage branch, GNM, recently explored three refinancing options to help homeowners meet a variety of financial goals.

read more

Fraud & Identity Theft

How to Protect Your Wallet from Holiday Fraud and Cyber Scams

The holiday season brings joy and generosity—but also an increase in scams targeting your finances. Learn how to spot red flags, avoid phishing attempts, and stay cyber-safe with GNCU’s expert tips. Protect your wallet and your cheer this season!

read more

Business

Leveraging GNCU’s Merchant Services for Holiday Sales Success

Choosing the best merchant services for your business is an important decision. GNCU’s Merchant Services offering includes a range of payment processing solutions tailored to meet the needs of growing small businesses.

read more

Business

Small Business Saturday: Why Supporting Local Businesses Matters

Support small businesses this Small Business Saturday! Learn why shopping local matters and how GNCU helps local businesses grow.

read more

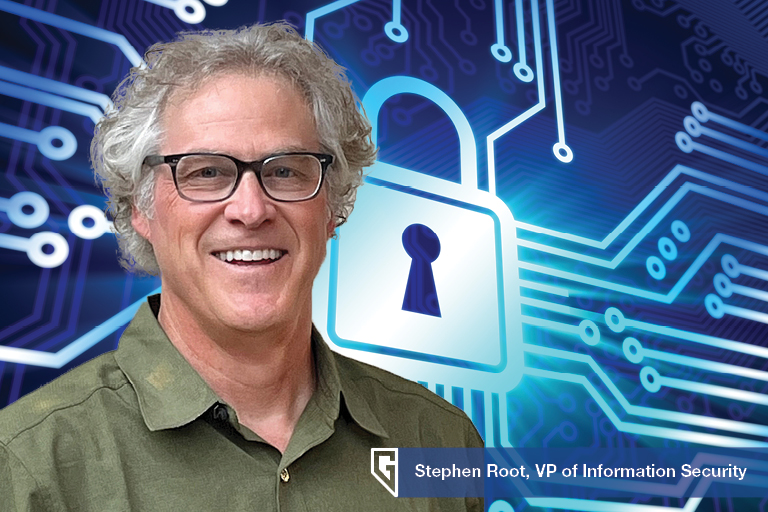

Fraud & Identity Theft

How to Stay Cyber Safe: Tips for Protecting Your Finances Online

Stay safe online with cybersecurity tips from GNCU. Learn to spot scams, act fast, and safeguard your finances against today’s cyber threats.

read more

Community

Practicing Gratitude to Improve Financial Wellness

Learn how gratitude can improve your financial habits, reduce stress, and inspire generosity for a healthier approach to money management.

read more

Budgeting

Gift Cards: A Smarter Way to Stick to Your Budget?

Use gift cards to stick to your budget and maximize spending. Learn how Prizeout adds value with bonus cash on popular brands.

read more

Business

Protecting Your Business Against Emerging Cybersecurity Threats

Cybersecurity strategies for businesses to protect data, prevent ransomware, and secure IoT devices. Learn how to build a strong business cybersecurity foundation and defend against cyber threats with expert insights and actionable steps from GNCU.

read more

Budgeting

Tips for Smart Spending This Holiday Season

Holiday shopping tips on saving, budgeting, and financing from GNCU. Explore Right Now Loans and the pros/cons of ‘buy now, pay later.’

read more

Debt

Haunted by Debt? 10 Tips to Break Free from Financial Fear this Fall

Feeling haunted by debt? Use these 10 smart debt management tips to exorcise financial woes and take control of your finances this fall with GNCU.

read more

Business

How to Prepare Your Business for the Holidays

Get your business holiday-ready with expert tips on marketing, inventory, staffing, and customer engagement.

read more

Fraud & Identity Theft

What to Do After a Data Breach: 10 Steps to Protect Yourself and Your Credit

Protect yourself after a data breach by taking action. Learn crucial steps to safeguard your personal and financial info.

read more

Loans & Credit

Tips to Prepare for a Pending Rate Cut and Corresponding Drop in Loan Interest Rates

When the Federal Reserve (or “the Fed” for short) hints at a rate cut, it might sound like jargon that only economists care about. But here’s what’s important: understanding what a Fed rate cut means for you can put you in control of your financial future, especially when it comes to managing debt or securing a new loan.

read more

Budgeting

Money Tips for New College Students

Starting college is an exciting time filled with new experiences, opportunities, and challenges. One of the biggest challenges for new college students is managing their finances. It’s easy to get overwhelmed with tuition, books, and living expenses, but with a few smart money tips, you can set yourself up for financial success.

read more

Business

Which Business Bank Account is Right for You?

Choose the right business bank account for your Nevada business. Learn about checking, savings, and credit options.

read more

Budgeting

Back-to-School Budgeting: Tips for Smart Spending

Budget effectively for back-to-school shopping with tips from GNCU. Save money and prepare for the school year stress-free.

read more

Budgeting

Expert Tips for Budget-Savvy Online Shoppers

Save money while shopping online with expert tips from GNCU. Learn how to stay budget-conscious and achieve your financial goals.

read more

Insurance

Understanding Supplemental Insurance

Learn about supplemental health insurance and how it fills the gaps in your coverage, giving you extra protection and peace of mind.

read more

Business

Leveraging Credit Union Services for Small Business Growth

Discover how GNCU’s services, from business accounts and loans to financial education, can help your small business grow.

read more

Budgeting

Revisit Your Spending Plan: A Mid-Year Financial Check-In

Revisit your spending plan to align with your financial goals, adjust for changes, and ensure long-term financial success.

read more

Budgeting

Tips for Budget-Friendly Vacations

Tips for budget-friendly vacations and affordable destinations near northern Nevada. Enjoy memorable getaways without breaking the bank.

read more

Business

How Credit Unions Empower Local Businesses

Celebrate Small Business Month by exploring how credit unions support local businesses with personalized service, lower fees, and community-focused solutions.

read more

Banking

A Guide to Finances for College Graduates

Essential financial tips for college graduates: budgeting, debt management, investing, and building income streams for a secure future.

read more

Insurance

What’s the Difference? Life Insurance vs. AD&D

Confused about Life Insurance vs. Accidental Death and Dismemberment (AD&D) coverage? Life Insurance protects your family after any death, while AD&D focuses on accidents.

read more

Fraud & Identity Theft

Stay Safe: Avoiding P2P Scams on Payment Apps

Peer-to-peer payment apps are convenient, but be cautious of P2P scams! Learn how to spot fake sellers, phishing attempts, and other scams.

read more

Debt

Tips for Buying a New Car or Truck

Discover various tools to help you feel confident when buying your next new or used car.

read more

Home

Is Homeownership Your American Dream

Getting a job and buying a home used to be the American Dream. However, lately homeownership rates have dropped and renting has increased.

read more

Retirement

What is an IRA CD?

Explore the benefits of an individual retirement account (IRA) certificate of deposit (CD) or IRA Share account and discover if they align with your financial goals.

read more

Taxes

Put Your Tax Refund to Good Use

Make your tax refund work for you. Explore how to use that refund in a way that sets you up for financial success.

read more

Loans & Credit

Good Uses of a HELOC Loan

A HELOC loan offers lower rates and access to large sums to invest in your life but use them wisely to avoid risking your home. Here’s how.

read more

Debt

Is a Debt Consolidation Loan a Good Idea?

Is a debt consolidation loan right for you? Learn about debt management strategies and find the best way to eliminate your debt.

read more

Loans & Credit

Navigating the Current Auto Market? What to Know Before You Shop

With limited inventory and above-average wait times for new vehicles, buyers who plan ahead may encounter fewer speed bumps in their car buying journey.

read more

Business

Strategies for Building Stronger Business Relationships

Learn essential strategies for building better business relationships. Discover useful tools from GNCU to support your small business growth.

read more

Budgeting

Financial Tips for Couples: Building a Strong Foundation Together

Essential financial tips for couples. From open communication to setting shared goals, learn how to navigate finances as a team.

read more

Home

Tips To A Better Home Renovation

Avoid the most common pitfalls of home renovations. Read 5 tips to a better home renovation with the help of Greater Nevada Credit Union.

read more

Business

End-of-Year Checklist for Small Businesses

A small business end-of-year checklist that covers essential tasks and strategies for ensuring your business’s continued growth and success.

read more

Savings & Checking

The 5 Essential Bank Accounts You Should Have

Unlock financial success with 5 essential bank accounts! Stay organized and build a secure future. Manage your money like a pro! 💼💵✨

read more

Business

Crucial Steps for Small Businesses to Fortify Against Cybercrime

Cybercrime is increasing but small businesses can be vulnerable to data breaches. Learn these tips to protect your business.

read more

Banking

Cash Back Checking vs. Free Checking Accounts

Discover the perfect match for your finances! Dive into the Cash Back vs. Free Checking guide. Optimize rewards and minimize fees.

read more

Debt

What is Debt Consolidation and When is it a Good Idea?

Explore the power of debt consolidation for financial freedom. Learn if it’s right for you and your path to a secure financial future.

read more

Loans & Credit

When Should I Refinance My Car Loan?

Thinking about refinancing your car loan? Explore the benefits and costs of this financial move with our comprehensive guide.

read more

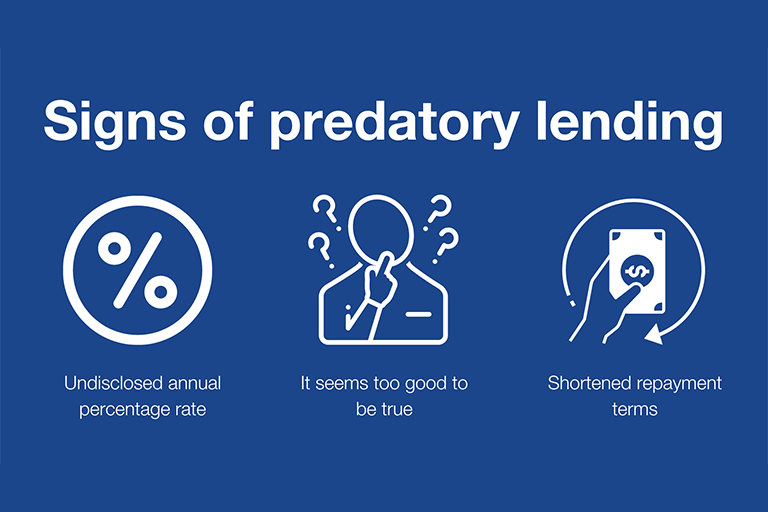

Loans & Credit

Top 3 Signs of Predatory Loans

Learn the Top 3 Warning Signs of Predatory Loans to protect your financial future. Spot shady offers and make smart borrowing decisions.

read more

Budgeting

Piggy Banks to Portfolios: Saving at Every Age

Saving money isn’t just a good habit — it’s a fundamental necessity. From your very first penny to retirement planning, saving plays an essential role in your financial journey.

read more

Fraud & Identity Theft

Account Alerts to Help You Protect Your Digital Banking Profile

Account Alerts help monitor your banking profile to protect your money and information. Learn about GNCU’s Digital Banking alerts.

read more

Fraud & Identity Theft

3 Practical Tips to Safeguard You From Identity Theft

Learn about the risks of identity theft, its potential consequences, and practical steps to protect yourself.

read more

Fraud & Identity Theft

4 Ways Bank Imposters Try to Scam You

Imposters posing as your financial institution are trying to trick you and drain your accounts. Here’s what you need to know to avoid getting scammed.

read more

Loans & Credit

Get Ready for Student Loan Payments to Resume

Student loan repayment is coming whether we like it or not. Get prepared with these expert strategies to handle student loan debt as payments resume.

read more

Community

3 Reasons to Join a Credit Union

Don’t sleep on a credit union for your banking needs! Here are three reasons to join a credit union: You get more. You have a voice. You’re investing in your community.

read more

Fraud & Identity Theft

5 Tips to Avoid Phishing Scams

We are constantly bombarded with attempts to steal our personal data and, ultimately, our money.

Through email phishing scams and text message smishing, cybercriminals are constantly evolving their tactics to scam you.

read more

Banking

Rewards Checking Account vs. Rewards Credit Card

In the world of personal finance, two heavyweights battle for your attention: rewards checking accounts and rewards credit cards. Both promise rewards and perks, but they serve different purposes. Let’s compare their features, advantages, and potential drawbacks to see which one suits you best.

read more

Loans & Credit

How to Improve Your Credit Score

Learn how improving your credit score from fair to very good can lead to substantial savings on car loans and mortgages. Get actionable credit improvement tips and access free online courses and expert guidance from Greater Nevada Credit Union for enhanced financial stability.

read more

Business

10 Tips to Master Your Business Budget

Discover the secrets to taming your business budget, setting realistic goals, and optimizing expenses. Don’t miss out on these strategies for long-term financial growth!

read more

Budgeting

Tips to Manage Inheritance to Maximize Your Financial Growth

Would you know what to do with an inheritance if you received yours today? Over the next two to three decades, the Baby Boomer generation is expected to pass on $30 trillion of accumulated wealth—a staggering sum that begs the important question: How do you manage inheritance?

read more

Budgeting

Plan a Family Vacation With Get Away Today

Planning a family vacation doesn’t have to be a budget-buster. Here’s what you need to know about planning a family trip on a budget – and how GNCU partner Get Away Today can help.

read more

Community

Unmuffled Stories

To celebrate Hot August Nights, we asked Greater Nevada employees about their experiences with their first cars. From clunkers to classics, these vehicles made a lasting impression on their drivers.

read more

Budgeting

What To Do With Extra Money

Extra money is always nice, but do you know how to make it work for you? Check out these tips from Greater Nevada Credit Union!

read more

Budgeting

Date Ideas on a Budget

Dating is expensive, but it doesn’t have to be! You can enjoy dating and stay on track with your financial goals. These Northern Nevada fun date ideas will get you started.

read more

Financial Education

3 Financial Tips for the Class of 2023

Greater Nevada Credit Union wants to prepare the class of 2023 for the future. Here are 3 for financially healthy habits.

read more

Financial Education

New Law Adds Nevada Financial Education Class to High School Curriculums

A new law adds a Nevada Financial Education class to high school curriculums, so students have the financial tools to help them in adulthood.

read more

Savings & Checking

How to Create a CD Ladder

CD Ladders help you take advantage of the higher yields of Share Certificates while giving you regular access to cash as you reinvest money.

read more

Financial Education

Financial Literacy Month

Here are five quick and easy tips to help you up your financial skills for Financial Literacy Month to make the most of your money.

read more

Loans & Credit

7 Tips for Your Perfect Car Loan

Before you take a test drive, it’s important to learn all your financing options to get the best loan for you.

read more

Budgeting

Manage Money and Have Fun

If you’re learning to manage money through personal budgeting, include some fun. How to enjoy your life while meeting your financial goals.

read more

Debt

Paying Down Debt

Paying down debt is a type of savings! See these quick tips for paying off your debt, consolidating your loans and freeing up some money.

read more

Loans & Credit

Credit Utilization Ratio

How much credit you have access to verse how much you use impacts your credit score a lot. Learn about Credit Utilization Ration.

read more

Online Banking Tools & Tips

Online banking tools make managing your finances and achieving your goals easier. Here are five ways to make the most of these online tools.

read more

Budgeting

Tuning your Financial Diet for 2023

Three tips to help you create a financial diet to help you pay off debt, create a balanced budget and create and emergency fund.

read more

Debt

Questions to Ask About Debt

If you’re thinking about taking out a loan or using a credit card, here are 12 questions about debt to ask before signing on the dotted line. Read more in this blog.

read more

Banking

Top 10 Tips to Save More Money This Holiday Season

With the holidays fast approaching, we’re all looking for ways to save more money for gifts, traveling, entertainment, and more. So, if you’re wondering how to save more money each month, we’ve got 10 manageable, realistic changes you can make to see your savings grow.

read more

Banking

Shop Local, Bank Local

When you bank with a local credit union like Greater Nevada Credit Union, your money stays in your community—just like when you shop locally. Learn more here!

read more

Loans & Credit

Why You Don’t Need a Perfect Credit Score

You know you need a high credit score to make your financial life easier. But if you’ve been striving for a perfect score — typically 850 — you need to know that it’s not worth it. Here’s why there’s really no need to hit that perfect three digit number.

read more

Loans & Credit

Buy Now, Pay Later Loans: Should You Use Them?

Buy Now, Pay Later Loans are becoming more popular, and it’s essential to understand how they can impact your credit score and whether they are the right choice for you.

read more

Loans & Credit

What is a Personal Line of Credit, and How Can It Help You?

A personal line of credit with Greater Nevada gives you immediate access to money when you need it, with terms that fit your financial needs.

read more

Budgeting

How To Make The Most Of Extra Money That Comes Your Way

From creating an emergency fund to paying off debt, here is a game plan to use extra money to make a meaningful impact on your life.

read more

Community

An Inside Look at Greater Nevada’s Early Response to COVID-19

We’re a people business. That’s why we jumped into action to help our community when the COVID-19 pandemic struck in March, 2020. In part one of our two-part interview with Greater Nevada President & CEO Wally Murray, read about the thoughts and actions that went in to keeping our communities alive and thriving through the financial hardships.

read more

Budgeting

Its Never Too Early To Start Saving

Learn about just some of the benefits of establishing healthy savings habits at a young age.

read more

Debt

Budgeting to Fit Your Lifestyle

Setting a budget is key if you want to reach financial success. Explore Greater Nevada Credit Union’s steps to creating a budget that fits your lifestyle.

read more

Budgeting

Money Matters for Newlyweds

One of the most common problems in marriage is finances. Explore various ways to discuss financial matters before you walk down the aisle.

read more

Parents

4 Tips to Teach Your Kids About Money Before College

Have an honest money conversation before your kid goes off to college. Read Greater Nevada Credit Union’s tips on how to teach your kids about money.

read more

Debt

What to Know Before Buying an RV, Motorhome, Trailer

If you’re looking for a new or used RV, motorhome, or trailer, Greater Nevada Credit Union has tips to help make the process easier. Explore more tips.

read more

Loans & Credit

How to Pay for College

Hooray! You’ve been accepted to college. Now the question is, “how do I pay for it?” With several different options, including pay as you go, scholarships, grants and student loans, finding the best way to finance your education can seem overwhelming. Here are some tips to make navigating the financial side of your college education that much easier.

read more

Loans & Credit

Choosing the Right Credit Card

The credit cards consumers choose can have a considerable impact on their overall financial health, so it’s important to choose wisely.

read more

Wellness

Improving Financial Wellness

Stress over financial struggles can make it harder to make good financial decisions. Escape the cycle! Start new healthy spending habits.

read more

Banking

What is Person-to-Person Payment?

Person-to-person, or a ‘P2P’ payment, is a term you may have heard in conversation or mentioned in passing. This new form of payment is a way to send or request money from your friends and family, or pay bills via an app faster and easier.

read more

Saving Money on Pet Ownership

Pets can make great companions, as long as you make sure you’re financially ready to make that companionship work.

read more

Retirement

How to Start a Retirement Plan

Are you living with uncertainty about having enough to enjoy retirement? If you don’t know how or where to start, here are some ideas.

read more

Children & Teens

Entrepreneurial Education for Our Youth

Basic money management skills are crucial to daily success but financial education isn’t commonly offered in schools. Here are some ways that you can teach children financial education.

read more